Bernie Madoff was responsible for one of the biggest investment fraud schemes in history. Madoff’s crimes captured the public imagination and will be remembered as a signature example of “crime in the suites.”

Although the Madoff scandal became the signature Ponzi scheme of a generation, it was rather exceptional. While most Ponzi schemes do not last very long before collapsing, Madoff was able to keep his going for several decades.

The scheme collapsed amidst the fallout of the 2008 subprime mortgage crisis, the bankruptcy of investment firm Lehman Brothers, and capital injections into the largest remaining Wall Street banks by the U.S. government.

Beginnings

A well-known and respected former chairman of the NASDAQ stock exchange, Bernard (Bernie) Madoff’s investors not those typically thought to fall victim to this type of Ponzi scheme. They were mostly wealthy, affluent, sophisticated investors who fell victim to Madoff’s promises of lavish returns.

Madoff started Bernard Madoff Investment Securities in New York City in 1960, becoming the first and only chairman of the firm. Like many white-collar criminals, he didn’t start off by committing fraud. Although not necessarily begun with malicious intent, he gradually fell into it over time to maintain the image of being a successful businessman.

The balance of the evidence suggests Madoff shifted his operations from established and accepted investing techniques into more questionable tactics beginning in the early 1990s. His goal was to maintain a steady flow of customers, maintain legitimacy, and enhance his standing among the upper echelons of the Wall Street establishment.

Enticing Investors

The essence of a Ponzi scheme is to promise attractive (and typically unrealistic) returns to entice investors. When money from new investments comes in, it is used to pay dividends to existing investors. This is how Ponzi scheme can carry on for so long. As long as money is coming in from new investors, everything appears normal to current investors.

Madoff enticed investors with promises of high returns using sophisticated computer software designed to identify patterns in the markets used to select lucrative business opportunities undiscoverable through conventional methods. Madoff was able to attract business by maintaining the aura of exclusivity, where only a few privileged individuals were permitted inside access.

Madoff facilitated the fraud by depositing investor money into his personal bank account at Chase Manhattan Bank instead of re-investing it, instead using the money to pay investors back whenever a withdrawal was made or a dividend payment was due. Madoff’s staff entered false trade dates on reports to fraudulently obtain the promised returns on paper, which gave the firm the appearance of legitimacy and profitability. Repeated over the course of many decades, this resulted in over $50 billion in fictitious obligations.

Hiding in Plain Sight

The Madoff fraud required tremendous secrecy and ignorance to succeed. Seemingly knowledgeable and responsible investors and regulators were unaware of or unwilling to see this “house of cards” for what it truly was. As a highly respected figure in the securities industry, investors inherently took Madoff at face value, permitting him enormous trust and leeway in how their money was handled. Madoff and his immediate family members obtained political influence through political contributions to prominent Democrats and access to the top levels of the Securities Industry and Financial Markets Association (SIFMA) and the SEC. These connections came under scrutiny when the Madoff scheme was uncovered, as the SEC was unable to uncover the fraud despite numerous complaints had been made and investigations initiated over the course of two decades.

The Scheme Unravels

The Madoff Ponzi scheme finally came to a head amidst the 2008 financial crisis. Several banks failed, others teetered on the brink of disaster, and the government injected hundreds of billions into them to stabilize the banking system. Amidst the panic, many investors tried to access their funds in late 2008, they discovered their money no longer existed. Madoff was unable to raise additional funds to pay off investors, resulting in the collapse of the scheme under the weight of billions of dollars in investor obligations.

Madoff later admitted he knew the scheme would eventually be revealed, realizing he would be unable to reconcile the financial discrepancies in his investment accounts. In December 2008, Madoff confided in his two sons that he could not meet $7 billion in investor payments, he was “finished,” and that his business was “just one big lie.” His sons relayed this to federal authorities, and Bernie Madoff was arrested several days later.

Criminal Charges

Madoff was charged with securities fraud, investment advisor fraud, mail fraud, wire fraud, money laundering, false statements, perjury, making false filings with the SEC, and theft from an employee benefit plan. He pled guilty in 2009, was sentenced to 150 years in prison, and ordered to forfeit over $17 billion to repay victims. Evidence suggests others were knowledgeable of the true nature of Madoff’s investment scam. Madoff tried to portray himself as the sole perpetrator, but several others have been convicted for their involvement in this Ponzi scheme, including accountant David Friehling and business associate Frank DiPascali, both of whom eventually pled guilty. Madoff is incarcerated at Butner Federal Correctional Institution, scheduled for release on November 14, 2139.

Victims

Many victims suffered complete losses, although some got a portion of their money back and claimed the losses on their income tax returns to reduce their tax burden. Victims suffered psychological and social damage above and beyond their financial losses. Many investment fund managers had contributed their entire funds to Madoff. This included Rene-Thierry Magon de la Villehuchet, who committed suicide two weeks after finding out $1.4 billion of his and his client’s money invested in the Madoff scandal had completely vanished. Many of the victims testified to this damage in court, arguing for lifetime incarceration and referring to Madoff as an “evil monster.”

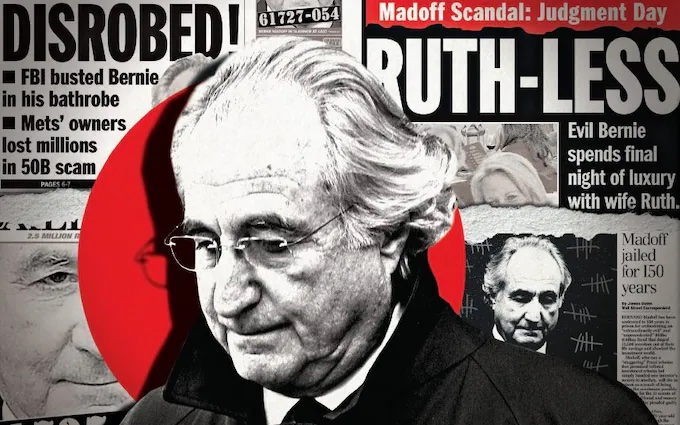

Media Coverage

The Madoff story was featured prominently in the media. The revelations of his Ponzi scheme came at a time when was a hot topic due to the subprime mortgage crisis, caused in large part by reckless, speculative risk-taking by major financial institutions. The Madoff Ponzi scheme is indeed worthy of attention as perhaps the most costly in history. It is a complex fraud with clearly discernable victims, a trail of warning signs, and a perpetrator willing to admit wrongdoing. These cases are easier to prosecute than are other major banking institutions more deeply intertwined with the global financial system. The Madoff fraud fit nicely into an attractive narrative of individual wrongdoing, with a greedy individual gaming the securities market while showing little remorse or empathy.

Aftermath & Implications

The Madoff scheme raised many questions about how such an operation could last this long. Although faced with many external factors beyond their control (e.g. resource constraints undermining the investigation of complex securities fraud cases, monetary incentives to look the other way for future reward of high paying Wall Street jobs, and political influence of Washington politicians), the SEC is ultimately responsible for the lack of oversight, including the failure to follow up on crucial evidence and prematurely ending numerous investigations.

Suggestions have come for increased diligence, discernment, and competence on the part of investors to identify red flags, avoid questionable investments, and report potential violations to authorities. Other recommendations have been made to fundamentally address pervasive corporate fraud, including the appointment of external auditors, federal charters for corporations, and amending the Constitution to end corporate personhood. These debates are ongoing and will continue as long as opportunities for large-scale financial frauds like the Madoff Ponzi scheme exist in an enabling environment of corporate greed.